If the US’ financial system have been an athlete, at this time it might be height LeBron James. If it have been a pop famous person, it might be height Taylor Swift. 4 years in the past, the pandemic briefly introduced a lot of the arena financial system to a halt. Since then, The usa’s financial efficiency has left different nations within the mud or even damaged a few of its personal data. The expansion price is top, the unemployment price is at historical lows, family wealth is surging, and wages are emerging quicker than prices, particularly for the running category. There are lots of tactics to outline a just right financial system. The usa is in super form consistent with almost about any of them.

The American public doesn’t really feel that manner—a dynamic that many of us, together with me, have just lately attempted to give an explanation for. But when, as a substitute of asking how other people really feel in regards to the financial system, we ask the way it’s objectively appearing, we get an excessively other resolution.

Let’s get started with economists’ favourite metric: progress. When an financial system is rising, more cash is being spent. Extra stuff is being produced, extra services and products are being carried out, extra companies are being began, extra staff are being employed—and, on account of this abundance, residing requirements are most definitely emerging. (At the turn facet, all over a recession—actually, when the financial system shrinks—lifestyles will get materially worse.) At the moment The usa’s economic-growth price is the envy of the arena. From the top of 2019 to the top of 2023, U.S. GDP grew by means of 8.2 p.c—just about two times as rapid as Canada’s, thrice as rapid because the Ecu Union’s, and greater than 8 instances as rapid as the UK’s.

“It’s laborious to consider a time when the U.S. financial system has diverged so essentially from its friends,” Mark Zandi, the executive economist at Moody’s Analytics, instructed me. Over the last 12 months, one of the crucial international’s largest economies, together with the ones of Japan and Germany, have fallen into recession, entire with mass layoffs and offended side road protests. Within the U.S., on the other hand, the post-pandemic recession by no means arrived. The financial system simply assists in keeping rising.

Nonetheless, progress is a crude measure that claims little or no about other people’s day by day lives. In all probability the appropriate query to invite is: Are maximum American citizens at an advantage financially than they have been ahead of the pandemic?

One faculty of idea maintains that the solution isn’t any, on account of the emerging value of residing. Thank you to a few years of higher-than-usual inflation, almost about the entirety prices greater than it did ahead of the pandemic.

Worth will increase on their very own, on the other hand, can’t let us know if the price of residing has long gone up. What truly issues is the connection between how pricey issues are and how much cash other people need to spend on them. As Vox’s Eric Levitz just lately identified, costs have greater by means of 1,400 p.c since 1947; that doesn’t imply American citizens have much less purchasing energy as of late than at a time when a 3rd of the rustic didn’t have operating water and 40 p.c lived in poverty. That’s in large part as a result of earning have greater by means of 2,400 p.c over the similar stretch. If costs cross up however other people’s earning cross up quicker, then the price of residing decreases. And that’s precisely what has came about within the U.S. over the last 5 years.

It took a while. When inflation used to be at its worst, in overdue 2021 and 2022, costs have been emerging too rapid for staff’ pay to maintain. Over the process 2023, on the other hand, the speed of inflation plummeted whilst wages saved emerging. In keeping with calculations by means of the economist Arindrajit Dube, costs rose about 20 p.c from the start of the pandemic to the top of 2023—however the median employee’s hourly wages had greater by means of greater than 26 p.c. In different phrases, a greenback in 2024 would possibly no longer cross so far as a greenback in 2019, however as of late the common employee has such a lot of extra greenbacks that they are able to manage to pay for a better high quality of lifestyles.

Some professionals dispute this. Loretta Mester, the president of the Cleveland Federal Reserve, just lately instructed The New York Occasions that salary progress hadn’t saved tempo with inflation, mentioning an indicator that tracks adjustments in reimbursement inside specific industries. However one of the not unusual tactics for staff to get a carry is to transport between industries, from lower- to higher-paying occupations—the way in which anyone running as a fry cook dinner, say, would possibly subsequent take a task as a package-delivery motive force. Principally each and every different measure of employee pay displays that wages adjusted for inflation are greater as of late than they have been ahead of the pandemic. Dube’s calculations are specifically dependable as a result of they’re in line with a dataset that tracks wages for particular person staff through the years.

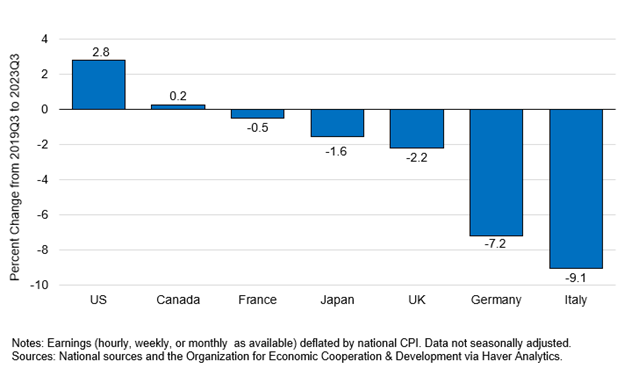

Different countries most definitely want that they had the luxurious of debating such technicalities. From the start of the pandemic in the course of the fall of 2023, the remaining length for which now we have just right comparative knowledge, actual wages in each Europe and Japan fell. In Germany, staff misplaced 7 p.c in their buying energy; in Italy, 9 p.c. By means of those metrics, the one staff in all of the evolved international who’re meaningfully at an advantage than they have been 4 years in the past are American ones.

Averages can hide so much, in fact. The upward thrust in inflation-adjusted wages, which economists name “actual wages,” is probably not such just right information if it have been flowing most commonly to the already-wealthy, because it did all over the restoration from the Nice Recession. Actually, from 1964 via 2018, actual wages for many staff rarely budged; nearly all positive factors went to the richest American citizens. Within the early days of the pandemic, when tens of millions of low-income staff discovered themselves out of a task, it might were cheap to be expecting the similar development to play itself out.

As a substitute, the other came about. A fresh research from the Financial Coverage Institute discovered that from the top of 2019 to the top of 2023, the lowest-paid decile of staff noticed their wages upward thrust 4 instances quicker than middle-class staff and greater than 10 instances quicker than the richest decile. A fresh running paper by means of Dube and two co-authors reached an identical conclusions. Salary positive factors on the backside, they discovered, were so steep that they have got erased a complete 3rd of the upward thrust in salary inequality between the poorest and richest staff over the former 40 years. This discovering holds even whilst you account for the truth that lower-income American citizens generally tend to spend a better percentage in their revenue at the pieces that experience skilled the most important value will increase lately, reminiscent of meals and fuel. “We haven’t observed a discount in salary inequality like this for the reason that Nineteen Forties,” Dube instructed me.

Pay in The usa is turning into extra equivalent alongside race, age, and schooling strains as properly. The salary hole between Black and white American citizens has gotten smaller to its lowest level since no less than the Nineteen Eighties. Pay for staff more youthful than 25 has greater two times as rapid as older staff’ pay. And the so-called faculty salary top rate—the pay hole between the ones with and with out a faculty level—has gotten smaller to its lowest measure in 15 years. (The gender pay hole has additionally narrowed rather, however a long way lower than the others.)

What explains this unexpected spice up in lower- and middle-class wages? The solution lies within the post-pandemic American hard work marketplace, which has been unbelievably robust. The unemployment price—outlined as the proportion of staff who’ve just lately appeared for a task however don’t have one—has been at or underneath 4 p.c for greater than two years, the longest streak for the reason that Sixties. Even that understates simply how just right the present hard work marketplace is. Unemployment didn’t fall underneath 4 p.c at any level all over the Nineteen Seventies, ’80s, or ’90s. In 1984—the 12 months Ronald Reagan declared “It’s morning once more in The usa”—unemployment used to be above 7 p.c; for many of the Clinton growth of the Nineties, it used to be above 5 p.c.

The most obvious upside of low unemployment is that individuals who need jobs can get them. A extra refined end result, and arguably a extra essential one, is a shift in energy from employers to staff. When unemployment is somewhat top, because it used to be within the years instantly following the 2008 monetary disaster, extra staff are competing for fewer jobs, making it more straightforward for employers to call for greater {qualifications} and be offering meager pay. That’s how you find yourself with tales about faculty graduates running as baristas for $7.25 an hour. But if unemployment is low and somewhat few persons are searching for jobs, the connection inverts: Now employers need to compete in opposition to one any other to draw staff, frequently by means of elevating wages. And—that is the an important section—those dynamics impact all staff, no longer simply people who find themselves out of a task.

This is helping provide an explanation for what came about after the pandemic. When the financial system first reopened, employers needed to fill tens of millions of positions. In the meantime, staff—flush with stimulus assessments and expanded unemployment insurance coverage—may manage to pay for to mention no to unhealthy jobs. In reaction, even famously low-paying corporations reminiscent of Amazon, Walmart, and McDonald’s began elevating wages and providing new advantages to draw staff. What used to be misleadingly classified the “Nice Resignation” used to be truly extra of an excellent reshuffling, as report numbers of staff give up a task to take a better-paying one. Over a higher couple of years, as American customers saved spending cash, call for for hard work stayed top. “Low-wage staff are after all getting a small style of the bargaining energy that extremely paid pros revel in as a rule,” Betsey Stevenson, a hard work economist on the College of Michigan, instructed me.

Thus far we’ve been speaking about wages: the cash persons are paid by means of their employer. To higher seize general monetary well-being, we would possibly as a substitute have a look at family wealth, which takes under consideration the overall vary of other people’s money owed and belongings. Over the last few years, American citizens have skilled the largest surge in wealth in no less than 3 a long time.

The gold usual for analysis into the state of American citizens’ funds is the Federal Reserve’s Survey of Client Budget, launched each and every 3 years. The most up-to-date file discovered that, from 2019 to 2022, the web price of the median family greater by means of 37 p.c, from about $141,000 to $192,000, adjusted for inflation. That’s the most important three-year build up on report for the reason that Fed began issuing the file in 1989, and greater than double the next-largest one on report. (In keeping with initial knowledge from the Fed, wealth persevered to upward thrust around the board in 2023.) Each and every unmarried revenue bracket noticed web price build up significantly, however the largest positive factors went to deficient, middle-class, Black, Latino, and more youthful families, producing a slight aid in general wealth inequality (although no longer just about as steep a discount because the decline in salary inequality). By means of comparability, median family wealth in fact declined by means of 19 p.c from 2007 to 2019.

The most important caveat to the wealth statistics is that a lot of the hot build up got here from the surge in house costs. A circle of relatives that’s wealthier on paper would possibly no longer really feel wealthy in the event that they must promote their house to understand any positive factors—particularly if the entire puts they could need to transfer to have got in a similar way pricey.

Certainly, the out-of-control value of housing is in all probability the largest black mark on an differently very good financial system. This drawback began a long time in the past—for the reason that Nineteen Eighties, the median U.S. house value has greater by means of greater than 400 p.c, two times as rapid as earning—and were given even worse all over the pandemic, as the upward thrust of far off paintings caused tens of millions of other people to hunt extra space. The ones emerging costs have collided with greater rates of interest to provide the maximum punishing housing marketplace in no less than a era. Would-be house owners can’t manage to pay for to shop for, and plenty of present house owners really feel caught in position.

Housing is considered one of a number of an important classes, at the side of childcare, well being care, and better schooling, that experience ballooned in value in fresh a long time, hanging a middle-class way of life additional and additional out of succeed in—what my colleague Annie Lowrey has known as the “Nice Affordability Disaster.” The previous few years of top rates of interest, which make borrowing cash dearer, have jacked up prices much more. And regardless of the hot just right information, the U.S. nonetheless has decrease lifestyles expectancy and far greater ranges of inequality, poverty, and homelessness than different prosperous countries. For tens of millions of other people, getting by means of in The usa used to be a battle ahead of the pandemic and remains to be a battle as of late.

Nonetheless, that doesn’t trade the truth that the U.S. financial system has had a exceptional four-year run, judged in opposition to each its personal historical past or the global pageant. A couple of years of excellent information isn’t sufficient to make up for 40 years of emerging inequality and stagnant wages. Nevertheless it’s an entire lot larger than the other.